The Green Premium of 2026: Why Eco-Conscious Assets are the New Global Safe Haven

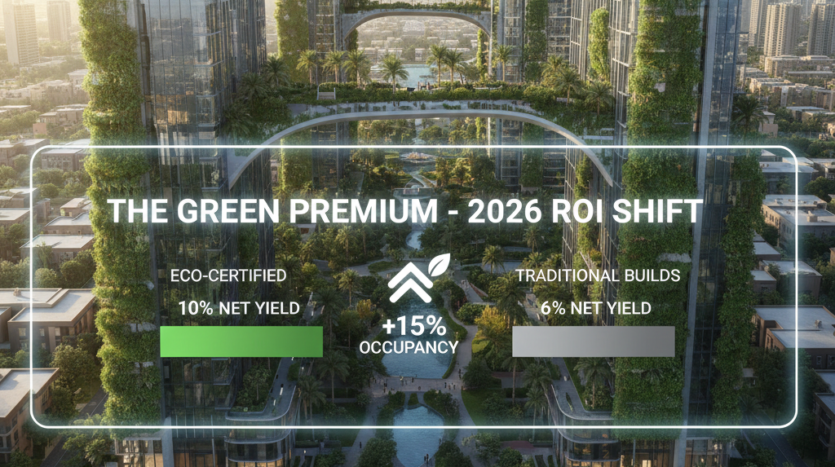

In the real estate landscape of 2026, the definition of “luxury” has undergone a radical transformation. While the early 2020s were defined by gold leaf and height, the mid-decade market is defined by efficiency, air quality, and infrastructure resilience. As 120,000 new units enter the Dubai market this year, the “Hunting Eyes” at Marvic Real Estate have observed a stark divergence in performance. Properties built with sustainable frameworks are currently maintaining 15% higher occupancy rates and commanding 8-10% higher rental premiums compared to traditional builds in the same districts.

Here is why “Green” is the most profitable color in your 2026 portfolio.

1. The "Bill Shock" Protection: Tenant Psychology in 2026

With the global cost of living remaining a primary concern for the UAE’s growing expatriate population, “Utility Transparency” has become a top-three search filter on property portals.

In sustainable communities like The Sustainable City, Expo Valley, and Ghaf Woods, integrated solar panels and high-performance building envelopes are more than environmental statements—they are financial shields.

The Data: A standard 2-bedroom apartment in a LEED-certified building saves a tenant approximately AED 6,000–8,000 annually on DEWA bills.

The Marvic Edge: We don’t just show you floor plans; we show you energy-efficiency ratings. A tenant who saves on utilities is a tenant who renews their lease. In 2026, retention is the secret to high Net ROI.

2. The Health-Wealth Connection: Wellness as an Amenity

Post-2024, the “Wellness Economy” in Dubai real estate exploded. In 2026, we are seeing “Bio-philic” design (integrating nature into architecture) move from a luxury niche to a mid-market requirement.

The Feature: Developments using Low-VOC materials and advanced HEPA filtration systems are seeing massive demand from the “Digital Nomad” and “Young Family” demographics.

The Impact: Communities like Al Barari and Sobha Hartland II are currently at 98% occupancy. Why? Because they offer “Cool Air Corridors” and shaded walking paths that allow for an outdoor lifestyle even in the shoulder months.

3. Regulatory Resilience: Meeting the "Net Zero 2050" Standards

The UAE’s Net Zero 2050 Strategy has moved from policy to practice. By 2026, building codes have tightened significantly.

Future-Proofing: Older, “energy-leaking” towers are beginning to face the threat of “Brown Discounting”—where property values drop because they require expensive retrofitting to stay compliant with new green mandates.

Marvic’s Strategy: We steer our clients toward developers who are exceeding current codes. Buying an eco-forward unit in Dubai Creek Harbour or Uptown Dubai today ensures your asset is still “Modern” in 2035.

4. ESG and the Global Exit Strategy

If you plan to sell your property in 5 to 7 years, you must look at who the buyers will be. The 2030 investor will be overwhelmingly focused on ESG (Environmental, Social, and Governance) criteria.

Institutional Demand: Global hedge funds and REITS are now mandated to hold a specific percentage of “Green Certified” assets.

Liquidity: An eco-friendly villa in MBR City isn’t just a home; it’s a globally compliant financial instrument. It attracts a wider pool of buyers, ensuring a faster exit and higher capital appreciation.

Marvic Real Estate’s "Green List" for Q1 2026

Our team has audited the current handover list. If you are looking for that 15% occupancy edge, these are the projects currently passing our “Hunting Eyes” test:

-

Ghaf Woods (Dubai Hills Area): A forest-themed community with natural cooling that reduces ambient temperature by up to 5°C.

-

The Sustainable City – Yiti (The Extension): Proven track record of zero vacancy and high communal trust.

-

Sobha Hartland II: Integrating $30\%+$ green cover with ultra-luxury finishing.

-

Dubai Silicon Oasis (Smart-Green Hub): The premier choice for tech-forward tenants looking for AI-managed energy savings.

The 2026 market doesn’t reward “more of the same.” It rewards the developers and investors who understand that resources are finite, but the demand for a better quality of life is infinite.

Don’t buy a legacy of high costs. Buy a future of high yields.